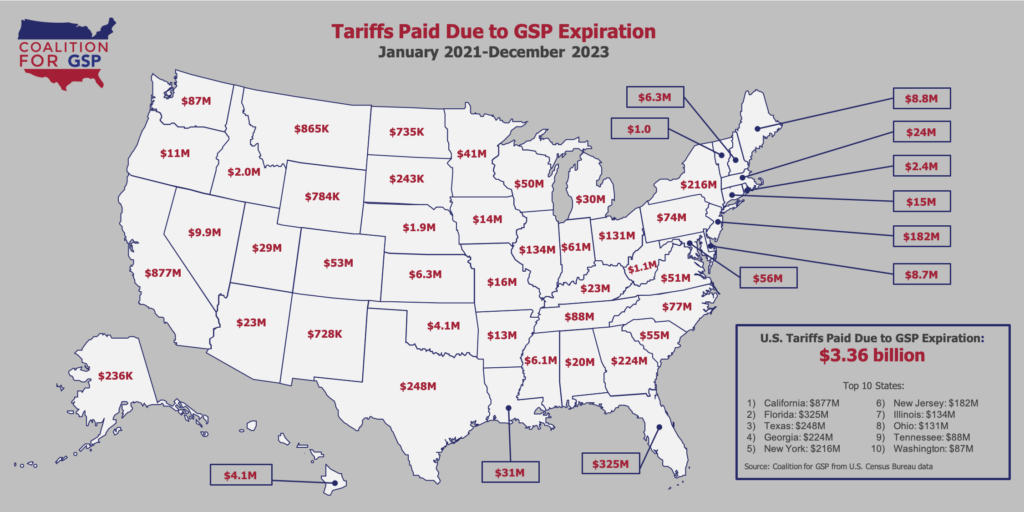

Based on an analysis of new U.S. Census Bureau data, American companies paid at least $3.36 billion in new tariffs from January 2021 and December 2023 due to GSP expiration. Imports into 8 states have faced $100+ million in extra tariffs because Congress let GSP expire, and 10 more states have faced between $50 million and $100 million in extra tariffs. The map below shows estimated tariffs paid for products claiming GSP by state.

GSP expiration punishes U.S. companies that reduced reliance on China. About 95% of the tariffs paid because Congress let GSP expire are for products subject to Section 301 tariffs if imported from China. For Maine, the figure is 99.98%. For all the talking about the importance of buying less from China, letting GSP remain expired for so long has actually pushed companies back to China, as highlighted by the Wall Street Journal.

The “real” cost of GSP expiration is likely much higher. Some importers may not know they are supposed to claim GSP despite the lapse. Many companies that are claiming GSP–especially small businesses–have been forced to take out loans or lines of credit to cover new tariff costs. For such businesses, the dollar cost of expiration includes both the direct tariffs and the interest payments needed to finance those costs for years. With dramatically higher interest rates today than when GSP first expired, the extended lapse could not come at a worse time.

It is critical that Congress pass a GSP reauthorization that refunds all tariffs paid and makes other positive changes as soon as possible. GSP users have big plans to invest in and grow their businesses, but often are frozen by the uncertainty of when Congress might act and what the renewal bill may include. Congress should include the bipartisan CNL Update Act and other provisions to help provide certainty to users that suffered from inaction for 3+ years.