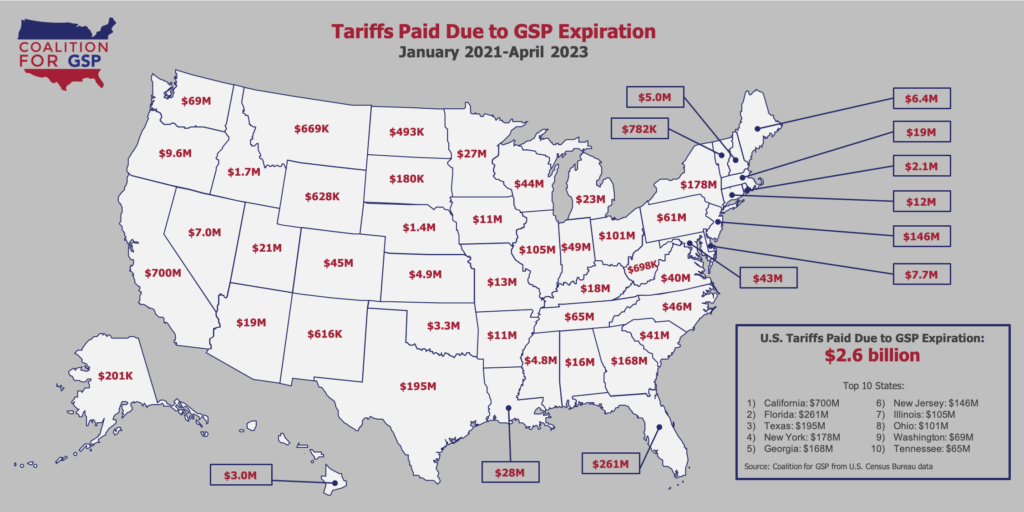

Based on an analysis of new U.S. Census Bureau data, American companies paid $2.6+ billion in new tariffs from January 2021 and April 2023 due to GSP expiration. Imports into 8 states have faced $100+ million in extra tariffs because Congress let GSP expire, and 22 more states have faced between $10 million and $60 million in extra tariffs. The map below shows estimated tariffs paid for products claiming GSP by state.

GSP expiration directly undermines any efforts to use Section 301 tariffs for leverage with China. About 95% of the tariffs paid because Congress let GSP expire are for products that are subject to Section 301 tariffs if imported from China. They are the products where U.S. importers are most desperate to find non-Chinese suppliers, but GSP expiration makes those alternative suppliers less viable.

As highlighted in this Wall Street Journal article, companies that moved from China to GSP countries feel punished for doing exactly what US policymakers wanted – and many report shifting imports back to China as a result of Congress’ inability to renew GSP. Official U.S. data show large import increases from China on a wide range of products — travel goods, wooden doors, jewelry, transformers, food products, to name just a few — in the two years after GSP expired. Generally, recent Chinese growth came despite sharp declines from 2017 to 2020 (when GSP was in place) and imports from China facing both regular and Section 301 tariffs.

The “real” cost of GSP expiration to date is likely well over $3 billion. In addition to the $2.6 billion in tariffs paid that we know about, hundreds of millions of dollars in tariffs have been paid on products that may qualify for GSP but didn’t claim it. Some portion of those tariffs likely will claim GSP post-renewal. Plus, there’s likely another $125+ million in tariffs paid since May 1.