On April 15, House Ways and Means Trade Subcommittee Chair Adrian Smith introduced the GSP Reform Act (H.R.7986). The bill would reauthorize GSP through December 31, 2030, refund all tariffs paid since GSP expired on December 31, 2020, and make significant changes to GSP rules related to country eligibility criteria, review processes, and product eligibility rules (e.g., competitive need limitations, rules of origin). The Ways and Means Committee also noticed a markup of the bill for April 17.

“We appreciate the introduction of the GSP Reform Act. The program has been expired for over 3 years, costing U.S. businesses over $3.5 billion in extra taxes over that time” said Dan Anthony, Executive Director of the Coalition for GSP. “The introduction starts an important process to renew GSP and refund those tariffs paid. GSP users look forward to working with Congress to address any ongoing concerns so the long overdue renewal can occur as quickly as possible.”

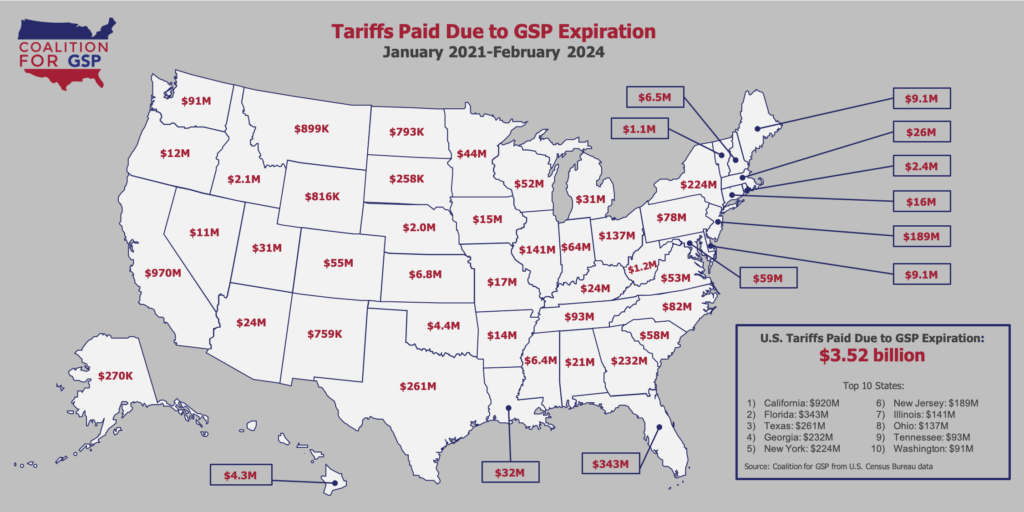

Since GSP expired, American companies in every have been forced to pay higher tariffs on qualifying products from GSP countries. The map below shows the estimated tariffs paid on imports into each state through February 2024.