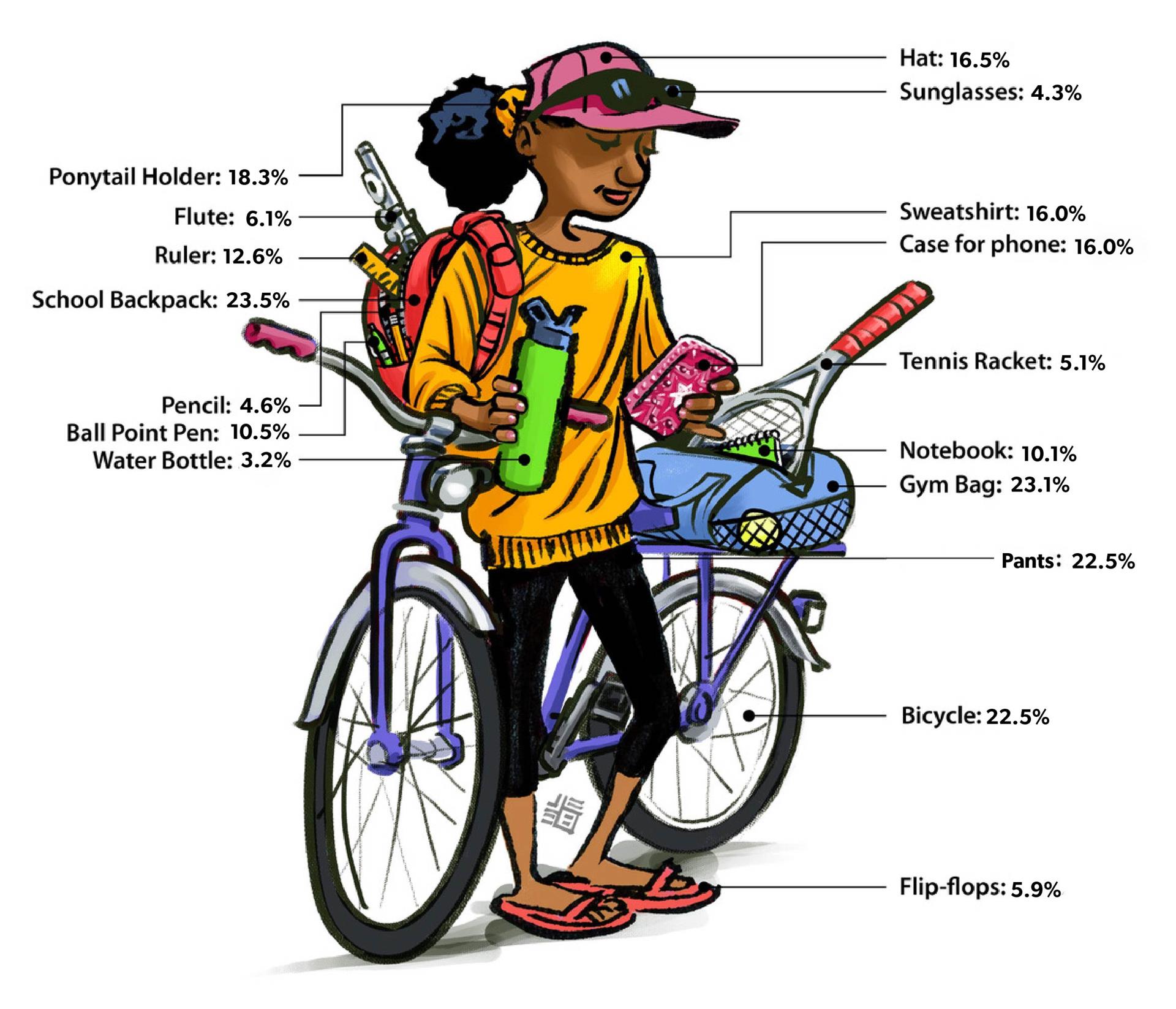

On Friday, the National Taxpayers Union published data showing how Back To School Season Highlights High Cost of Import Taxes, including the great graphic below. Sadly, even those high tariffs are understated because they don’t account for the impacts of GSP expiration. NTU’s selected products faced at least $120 million in extra tariff payments in 2021, raising the real tariff rates faced even higher.

This stems from a reporting quirk that most people may not know: because tariffs paid during GSP lapses have always been refunded after renewal, the Census Bureau reports $0 in “calculated duties” for any product claiming GSP even though companies must pay the tariffs to import. NTU’s underlying data helps us show which products faced significantly higher tariffs:

- Backpacks: 28.4% real average tariff. Backpacks faced $50 million in extra tariffs due to GSP expiration in 2021, raising tariffs paid to $286 million on a little over $1 billion in total imports.

- Gym bags and similar products: 28.1% real average tariff. These products faced $49 million in extra tariffs due to GSP expiration in 2021, raising tariffs paid to $273 million on $970 million in total imports.

- Pencils: 6.2% real average tariff. Pencils faced $3.4 million in extra tariffs due to GSP expiration in 2021, raising tariffs paid to $13 million on a little over $200 million in total imports, well above the 4.6% tariff implied by the official data.

- Electric guitars: 5.7% real average tariff. Flutes were in the graphic, but not a big GSP import last year. However, more than a quarter of all U.S. electric guitar imports claimed GSP, and they faced $4.6 million in extra tariffs due to GSP expiration in 2021. Total tariffs paid were $18 million on $310 million in total imports for a real average tariff that is almost 40% higher than the 4.2% rate implied by the official data.

- Bicycles: GSP-claiming products faced $15 million in extra tariffs due to GSP expiration in 2021. However, many bicycles from Cambodia did not claim GSP in the early months of 2021 especially, so the impact is bigger (more than $15 million in tariffs are likely eligible for refunds). Given the claiming issue, it is impossible to know the “real vs reported” until companies can file refund claims, but it is tens of millions of dollars in extra tariffs.

The NTU graphic used 2021 data – so we did too – but GSP expiration’s harm on “Back to School 2022” is likely even bigger. The share of imports from the world claiming GSP for many of these products is rising as companies seek to diversify sources out of China. The share of backpack imports from the world claiming GSP rose from 28% in 2021 to 32% in the first half of 2022, “gym bag” products rose from 26% to 32%, and pencils rose from 27% to 30%.

Similarly, while only 1.5% of flutes claimed GSP in 2021, that figure rose to 12.5% in the first half of 2022. GSP imports of flutes have averaged $272,000 per month in 2022, versus $255,000 in all of 2021.

Extra tariffs on flutes and all those other products may not be noticed by policymakers, but there are surely some parents out there wondering why it costs so much to buy a new flute this year. Congress can help alleviate these pressures – or at least for Halloween and holiday shopping – by renewing GSP when it returns in September.